Forex Fundamental Analysis - US wage growth puts pressure on the euro

EURUSD - Up Events to watch out for today: 17:00 GMT+3. USD - ISM manufacturing index 21:00 GMT+3. USD - FOMC decision on the key interest rate EURUSD: EURUSD dipped below the 1.0670 level on Tuesday after an unexpected rise in U.S. wages reignited fears of stagnant inflation, lowering expectations of rate cuts and sending investors to safe-haven areas. With European markets mostly closed on Wednesday due to Labor Day, investors will be focused on the Federal Reserve's (Fed) latest rate decision. Markets generally expect the Fed to keep rates on hold for now, but market participants will actively seek clearer policy guidance from the U.S. central bank as concerns over inflation and a sharp slowdown in U.S. economic growth keep market sentiment on hold. U.S. home prices and business payroll costs showed acceleration on Tuesday, while consumer and business sentiment surveys simultaneously fell sharply. Investors have resigned themselves to the prospect of a stagnant economy and inflati

EURUSD - Up

Events to watch out for today:

17:00 GMT+3. USD - ISM manufacturing index

21:00 GMT+3. USD - FOMC decision on the key interest rate

EURUSD:

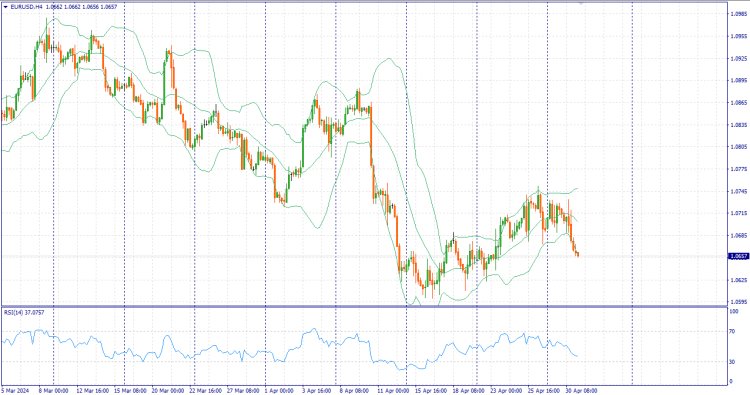

EURUSD dipped below the 1.0670 level on Tuesday after an unexpected rise in U.S. wages reignited fears of stagnant inflation, lowering expectations of rate cuts and sending investors to safe-haven areas.

With European markets mostly closed on Wednesday due to Labor Day, investors will be focused on the Federal Reserve's (Fed) latest rate decision. Markets generally expect the Fed to keep rates on hold for now, but market participants will actively seek clearer policy guidance from the U.S. central bank as concerns over inflation and a sharp slowdown in U.S. economic growth keep market sentiment on hold.

U.S. home prices and business payroll costs showed acceleration on Tuesday, while consumer and business sentiment surveys simultaneously fell sharply. Investors have resigned themselves to the prospect of a stagnant economy and inflation that is too high, preventing the Federal Reserve from cutting rates at the faster pace investors expect from early 2024.

According to CME's FedWatch tool, the betting markets now see only one quarter-point Fed rate cut this year, with a 54% probability of no rate cut in September and only a 57% probability of a 25 basis point rate cut at the Fed's November meeting.

Trading recommendation: Trade mainly with buy orders at the price level of 1.0685. We consider sell orders at the price level of 1.0630.

Up to $20 for each lot in real money - get a guaranteed income by connecting Cashback promotion!

ff_rss_other_analytic

Gabung Komunitas Telegram zignalforex.com dapatkan update terbaru Analisa forex trading dan berita forex terupdate. klik disni untuk Gabung Telegram zignalforex https://t.me/zignalfx

dan ikuti saluran Whats App zignalforex.com whats app zignalforex

Trading Bersama ZignalforexTrading di Pialang Terpercaya bersama zignalforex.com . Berikut Rekomendasi Broker Forex kami :

| Broker | Min Deposit | Leverage | Swap | Detail |

|---|---|---|---|---|

| HSB Investasi | Rp2,4 jt / $200 Rate Rp12.000 | Hingga 1:200 | - | Detail |

DISCLAIMER : Perdagangan dengan leverage dalam mata uang asing atau produk di luar bursa dengan margin membawa risiko yang signifikan dan mungkin tidak cocok untuk semua investor. Kami menyarankan Anda untuk mempertimbangkan dengan hati-hati apakah perdagangan sesuai untuk Anda berdasarkan keadaan pribadi Anda. Perdagangan valas melibatkan risiko. Kerugian bisa melebihi setoran. Kami menyarankan Anda mencari saran independen dan memastikan Anda sepenuhnya memahami risiko yang terlibat sebelum berdagang.

What's Your Reaction?