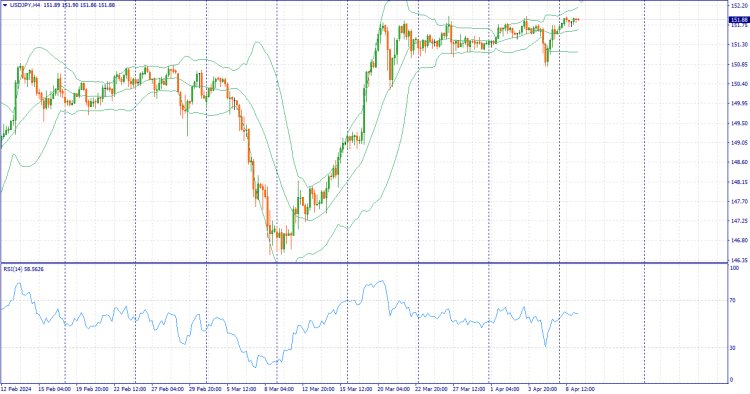

Forex Fundamental Analysis - Large gap between USD and JPY interest rates

USDJPY - Down USDJPY: JPY investors remain on guard for the possibility of Japanese authorities intervening to support the local currency, which in turn keeps JPY bears away from new bets. That said, the Bank of Japan's (BoJ) dovish forecast that monetary policy will remain accommodative for some time, as well as the overall positive tone in equity markets continue to undermine the safe-haven JPY. The US Dollar (USD) continues to receive support from expectations that the Federal Reserve (Fed) may delay interest rate cuts. This suggests that the gap between US and Japanese interest rates will remain wide, which in turn is another factor contributing to the USDJPY pair. However, dollar bulls prefer to wait for more signals on how the Fed will cut rates. Thus, attention will be focused on the release of US consumer inflation data for March and the minutes of the FOMC meeting on Wednesday. Trading recommendation: Trade with buy orders when the price reaches 152. Sell at the price level

USDJPY - Down

USDJPY:

JPY investors remain on guard for the possibility of Japanese authorities intervening to support the local currency, which in turn keeps JPY bears away from new bets. That said, the Bank of Japan's (BoJ) dovish forecast that monetary policy will remain accommodative for some time, as well as the overall positive tone in equity markets continue to undermine the safe-haven JPY.

The US Dollar (USD) continues to receive support from expectations that the Federal Reserve (Fed) may delay interest rate cuts. This suggests that the gap between US and Japanese interest rates will remain wide, which in turn is another factor contributing to the USDJPY pair. However, dollar bulls prefer to wait for more signals on how the Fed will cut rates. Thus, attention will be focused on the release of US consumer inflation data for March and the minutes of the FOMC meeting on Wednesday.

Trading recommendation: Trade with buy orders when the price reaches 152. Sell at the price level of 151.70.

Our company provides an opportunity to earn income not only from your trading. By attracting clients within the affiliate program, you can get up to $30 per lot!

ff_rss_other_analytic

Gabung Komunitas Telegram zignalforex.com dapatkan update terbaru Analisa forex trading dan berita forex terupdate. klik disni untuk Gabung Telegram zignalforex https://t.me/zignalfx

dan ikuti saluran Whats App zignalforex.com whats app zignalforex

Trading Bersama ZignalforexTrading di Pialang Terpercaya bersama zignalforex.com . Berikut Rekomendasi Broker Forex kami :

| Broker | Min Deposit | Leverage | Swap | Detail |

|---|---|---|---|---|

| HSB Investasi | Rp2,4 jt / $200 Rate Rp12.000 | Hingga 1:200 | - | Detail |

DISCLAIMER : Perdagangan dengan leverage dalam mata uang asing atau produk di luar bursa dengan margin membawa risiko yang signifikan dan mungkin tidak cocok untuk semua investor. Kami menyarankan Anda untuk mempertimbangkan dengan hati-hati apakah perdagangan sesuai untuk Anda berdasarkan keadaan pribadi Anda. Perdagangan valas melibatkan risiko. Kerugian bisa melebihi setoran. Kami menyarankan Anda mencari saran independen dan memastikan Anda sepenuhnya memahami risiko yang terlibat sebelum berdagang.

What's Your Reaction?